The Importance of Minute Books in Canada for Your Business

Introduction

Running a successful business in Canada requires adherence to various legal and financial obligations. One important aspect is maintaining accurate and up-to-date minute books. Tax Accountant IDM, a leading provider of financial services, accountants and tax services, understands the significance of minute books for businesses across the country.

Understanding Minute Books

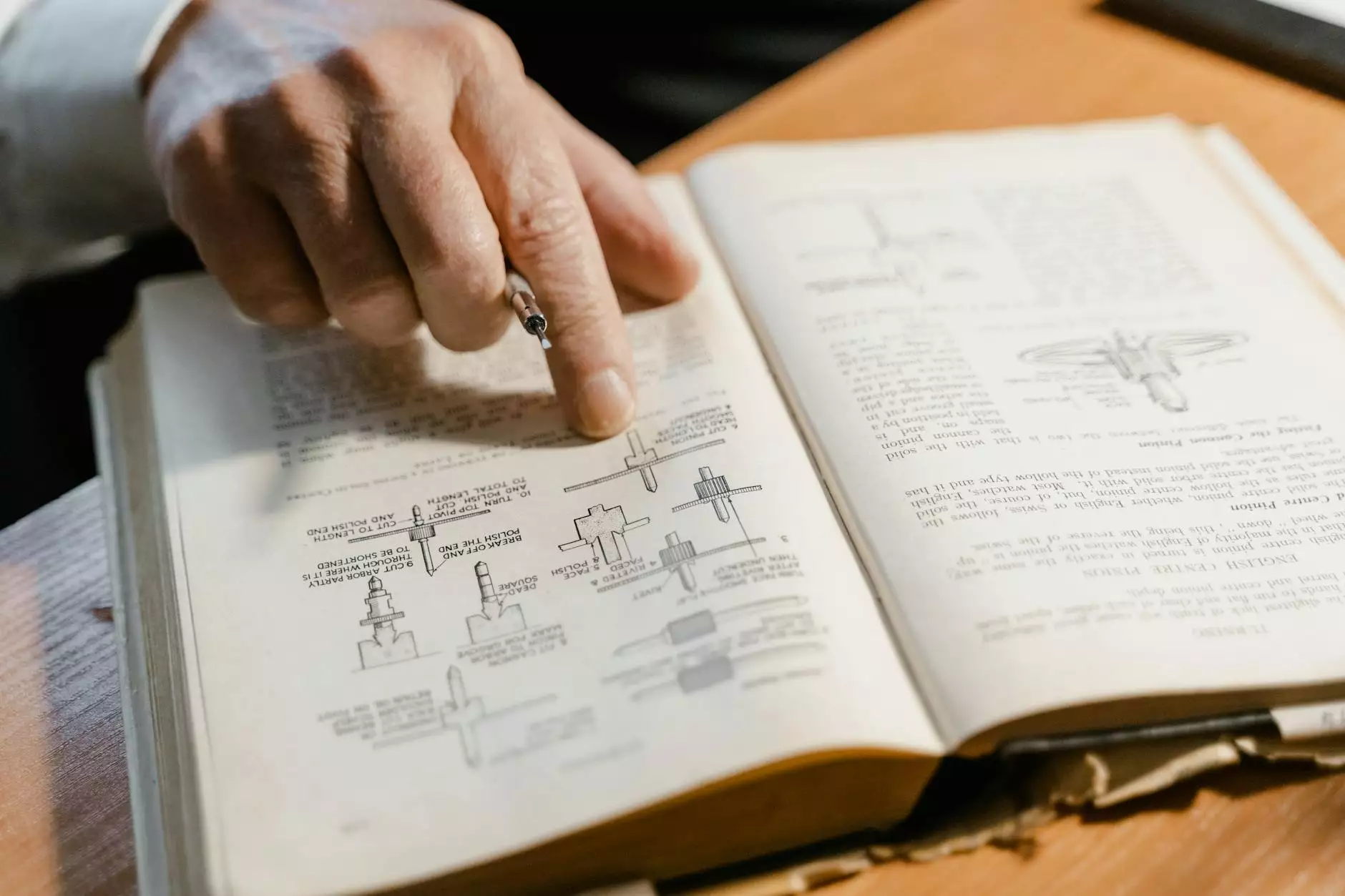

In the context of Canadian business regulations, a minute book refers to a collection of key corporate documents, records, and minutes of meetings that outline the decision-making process and statutory requirements of a company. It serves as a comprehensive record of the company's activities, resolutions, and other important information. Minute books are legally required for both small businesses and large corporations in Canada.

The Importance of Maintaining Minute Books

Accurate and well-maintained minute books are crucial for various reasons:

Compliance with Corporate Law

Compliance with corporate laws is a fundamental requirement for all businesses. Failure to maintain proper minute books can lead to legal consequences and potential penalties. Tax Accountant IDM ensures that your minute books are meticulously prepared and updated to ensure compliance with the Canadian corporate law.

Precise Record-Keeping

Minute books act as a repository of vital information for a company. They document corporate decisions, resolutions, shareholder meetings, director appointments, and other changes within the organization. This accurate record-keeping helps build a strong foundation for future decision-making and serves as valuable evidence in legal matters or audits.

Corporate Governance

Effective corporate governance is essential for the long-term success of any business. Up-to-date minute books promote transparency and accountability within an organization. They outline the roles and responsibilities of directors, officers, and shareholders, ensuring proper governance and mitigating the risk of conflicts of interest or legal disputes.

Facilitating Business Transactions

When engaging in various business transactions such as mergers, acquisitions, or obtaining financing, potential partners, lenders, or investors require access to accurate and well-maintained corporate records. A comprehensive minute book enhances your business's credibility and facilitates a smooth due diligence process.

The Role of Tax Accountant IDM

Tax Accountant IDM specializes in providing financial services, accountants, and tax services to businesses across Canada. With our expertise, we assist businesses in maintaining precise and complete minute books, ensuring compliance with legal requirements and optimal corporate governance.

Conclusion

In conclusion, minute books are an integral part of every Canadian business, regardless of size or industry. Tax Accountant IDM understands the importance of accurately maintaining these records to ensure compliance and support your business's growth. By choosing Tax Accountant IDM, you gain access to top-notch financial services, accountants, and tax services to help you manage your minute book requirements efficiently. Contact us today to ensure your minute book needs are met!

minute book canada